The United States continues to face an obesity epidemic. According to the National Heart, Lung, and Blood Institute, around 75% of adults in the US are considered overweight or obese. This has significant health consequences, as obesity is a major risk factor for heart disease, stroke, and type 2 diabetes. In response to this growing… Continue reading Why Are Prescription Weight Loss Medications Being Used So Widespread Across the US?

Score Big Savings: The Best Ways to Buy Clothing Online at a Discount

Key Takeaways Shopping at strategic times can lead to significant savings. Coupons and promo codes are easy to apply and offer instant discounts or perks. Free shipping can often decide between a good and a great deal. Online shopping provides a spectrum of opportunities for savvy shoppers to secure fashion at a discount. Table of… Continue reading Score Big Savings: The Best Ways to Buy Clothing Online at a Discount

The Importance of the SSI Death Index in Genealogical Research

When researching more recent ancestors, the Social Security Death Index is a great place to start. It lists people who died and were reported to the Social Security Administration beginning in 1962 (a small number of deaths are listed before this date). Internet sources based on the SSA DMF have shown high sensitivity to ascertain… Continue reading The Importance of the SSI Death Index in Genealogical Research

Mastering Your Skills:Training Tips for Synthetic Ice Rink Skaters

Mastering a skill is a process that requires clear goals, research and information gathering, consistent practice, and feedback from peers. By following these ten steps, anyone can become an expert in their craft. Though hockey was designed to be played on natural ice, synthetic rinks can benefit novice and experienced skaters. The slight resistance synthetic… Continue reading Mastering Your Skills:Training Tips for Synthetic Ice Rink Skaters

Navigating the Search: Where to Find Dogs for Sale in Your Neighborhood

Purchasing a puppy can be one of the most exciting decisions ever. But if you want to be sure that your new fur-ball is healthy and happy, there are some things to remember. You can search by breed, age, location, and more. Websites One of the best ways how to find puppies for sale near… Continue reading Navigating the Search: Where to Find Dogs for Sale in Your Neighborhood

How to Choose the Right Fabric Supplier for Your Production Needs

Fabric suppliers are divided into a few different categories. Mills provide made-to-offer fabrics with substantial minimums, while wholesalers, known as converters, purchase unfinished or greige goods from mills and then process them into finished products. Jobbers carry limited stocks of fabric left over from converters and mills that they sell at reduced prices. They typically… Continue reading How to Choose the Right Fabric Supplier for Your Production Needs

The Role of Employee Self-Service Software in Empowering and Engaging Your Workforce

Employee self-service software allows employees to manage and handle a variety of human resources-related tasks on their own. These tools can be standalone or integrated with other HR apps and platforms. Although no ESS portal can replace expert HR professionals, smart ESS software frees HR staffers from routine tasks and gives employees more direct control… Continue reading The Role of Employee Self-Service Software in Empowering and Engaging Your Workforce

Find The Best Escape Room and Feel A Thrilling Experience With Friends

Do you plan to spend a weekend with your friends but have no ideas? We have the answer. You don’t need to look for different activities or stay at home. There’s an escape room experience waiting for you. What do you think? This is an awesome and mind-blowing game that will give you tons of… Continue reading Find The Best Escape Room and Feel A Thrilling Experience With Friends

Makita Tool Box

Very rarely there are cases when you can construct, establish, or repair something with just one tool. Nine times out of ten it is necessary to use at least two instruments at the same time. However, how often tools are hidden in different places around the house, which are usually forgotten. So, instead of quickly… Continue reading Makita Tool Box

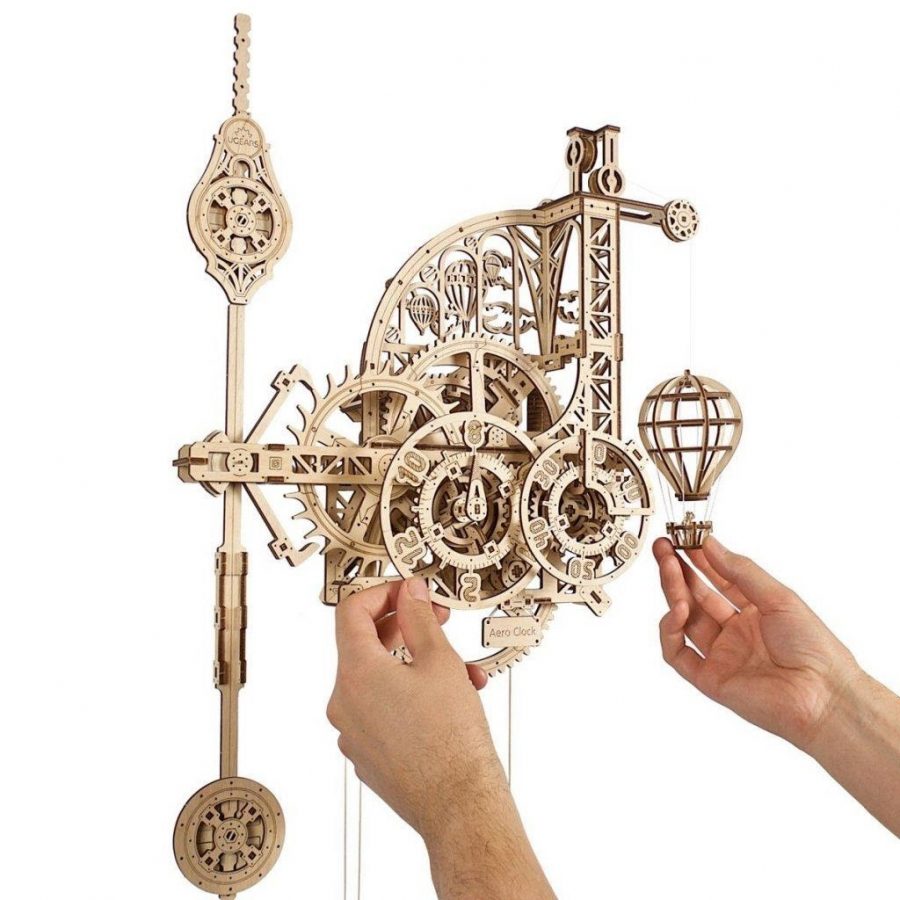

Save Time With UGears Aero Clock!

Year after year, human dependence on digital technologies is growing. People are more immersed in the virtual world and become farther from the real one. At such moments, one may feel a lack of physical interaction with objects of the surrounding world. Interesting and unhurried hobbies can become a great solution (for example, assembling a… Continue reading Save Time With UGears Aero Clock!

Are There Any Good Subreddits For Sexting or Online Websites?

If you’ve been on the internet for long enough then you already know that Reddit is one of the best sources for web sites that you should be on. You never know what you’re going to come across there, but you can usually be sure that it’s going to be really good. If you’re also… Continue reading Are There Any Good Subreddits For Sexting or Online Websites?

5 Things to Do at Marina Bay Sands In Singapore

Marina Bay Sands is one of the world’s premier attractions. Lining its namesake bay, the resort comprises three main towers that were designed to resemble decks of cards. It really is a marvel to behold, lighting up the skyline as evening falls. Its interior is just as impressive, both in terms of décor and activities.… Continue reading 5 Things to Do at Marina Bay Sands In Singapore