Financial planning can be an incredibly daunting task, but it becomes even more complicated and stressful if you need to make provisions for a child or family member with special needs. That said, no matter how daunting a task it might be, it’s vitally important to ensure you have made financial provisions to ensure they aren’t made to suffer.

If you don’t leave enough money or support to take care of your family member with special needs, their wellbeing could suffer, but if you leave too much they could lose out on critical government support.

No Plan

It’s never too early or too late to start putting provisions in place to take care of your loved ones. The only mistake you can make is not having any financial plan at all. Even if you only have a small estate or limited means, don’t underestimate how important it is to undertake proper financial planning.

Letter of Intent

If you’re not quite ready to put a full financial plan in place, you could start by writing a letter of intent outlining what you want for an individual and your estate. This letter could also include vital information such as the individual’s daily routine and what they do or don’t like. Having this information written down can seriously help if anything happens to you to ensure your loved one can continue to receive the care and support they need.

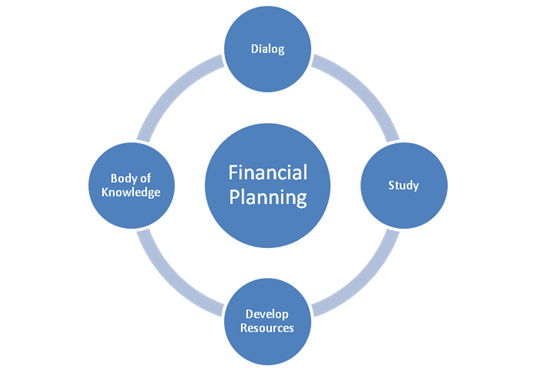

Financial Planning

Although a letter of intent is a great step, it can’t beat proper financial planning. Getting a financial adviser can help you navigate the complex world of financial services.

You can visit Intelliflo for software for IFAs to find all the guidance and information you might need when it comes to investment planning.

Ensuring you find an adviser who uses the best possible software for IFAs can give you the peace of mind you need when planning for your family’s future. If you can’t afford an IFA, try talking to other families with special needs or look into free training courses to get advice on how to plan for the worst.

Support groups, certified financial planners and disability law attorneys can help you navigate the various tools available when it comes to financial planning so you can be sure to keep your family safe.